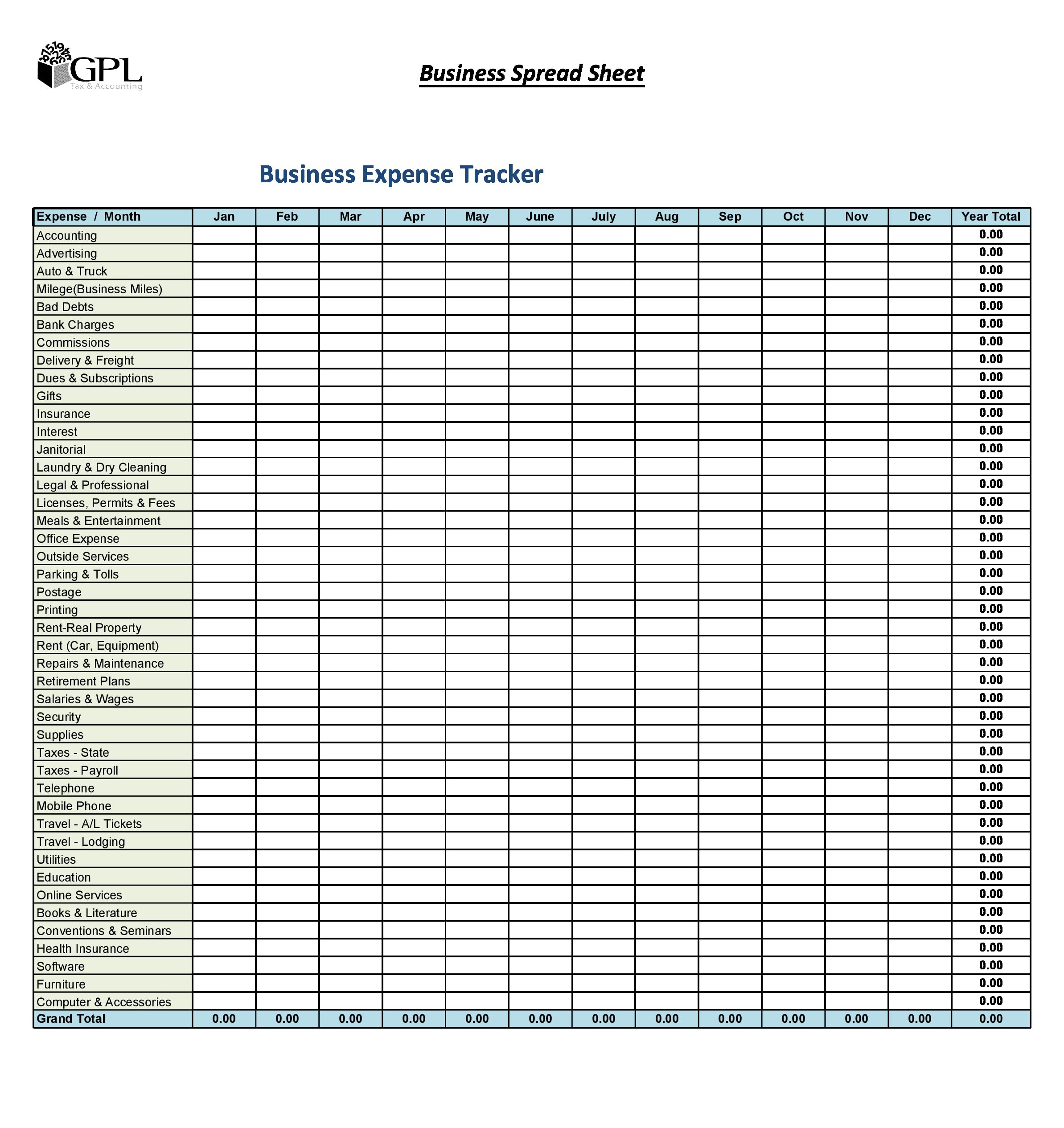

Here, you'll see how much you spent on each Schedule C category over the course of the tax year.įor example, say you've spent $1,200 between your personal assistant, your marketing freelancer, and your web designer. With the Schedule C line number right there, you can be confident that, if the IRS ever comes knocking, you can provide them with required information that matches up exactly with the form. This column provides a great way to do that. But with taxes, it always pays to give things a once-over before you submit. The column is a great way to double-check your return and avoid the IRS’s attention - something no freelancer wants.Įspecially if you're filing online, it's easy to rush through things because you were hungry for that tasty refund. Advertising expenses, for example, are on line 8 of the form.

#Tax small business expense spreadsheet template free how to

This column shows you how to match up expense categories on this sheet with the lines on a Schedule C. Visit an office supply store? Have a meal to talk about your business? All of those are tax deductions. Travel to meet a client? You get a deduction. Schedule C forces you to split up your write-offs into different, somewhat arbitrary categories.ĭo you pay for advertising? You get a deduction. But in a nutshell, your Schedule C is the form you use to tell the IRS what business expenses you're writing off every year. If you'd like a detailed run through of this tax form, I recommend checking out Keeper Tax's guide to filling out your Schedule C.

If you've ever been through the process of filing self-employment taxes by hand, everything in this column will look pretty familiar from your Schedule C.

So add your write-offs, and watch that number go up! It's calculated automatically based on everything you fill out in the template.

0 kommentar(er)

0 kommentar(er)